Despite the headlines these days regarding inflation, which is at an almost 40-year high, safe havens are on the horizon with investments in real estate, specifically land real estate, as an alternative to investments in stocks. Many people are evaluating what to do with their savings after being in lockdown for the past couple of years, especially after the volatility of the economy. So, what’s the real story here? How can you protect yourself from inflation’s negative effects?

The answer could lie in becoming a land investor. Land real estate investments can protect you against inflation because over time land property values tend to rise steadily. According to some experts, it’s a good idea to buy real estate now due to low interest rates, despite a hot and competitive market.

⠀⠀

What You Need to Know About Using Land Real Estate as a Hedge

⠀⠀

Home and land prices rise over time, lowering the loan-to-value of any financing, resulting in a natural discount. The equity on the property will increase, while the fixed-rate payments will remain the same. Increasing home and land prices equates to higher rents for a real estate investor with income producing properties, especially those with short-term leases like agricultural production arrangements, homes and multi-family properties. You can increase your cash flow if you increase your rent while keeping your debt-payments the same for your real estate investment.

Lastly, property values tend to stay on a steady upward curve over time with the real estate market, which can make real estate a good hedge against inflation. After the real estate bubble burst in 2008, many properties had returned to their pre-crash prices within a decade. A real estate investor can also benefit from real estate investments in the form of recurring income and appreciation that keeps pace or exceeds inflation.

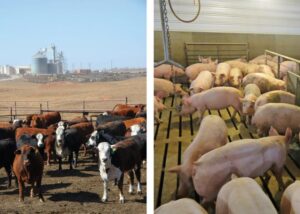

Agricultural properties may provide an effective hedge against inflation, as individual food costs generally grow with inflation and tenants generally renew their leases every year. Investing in a farm or ranch property may be a wise option during this time of overall market uncertainty with the hard assets that the real estate markets offer.

⠀⠀

Historically inflation has always been a driver for the land market. Usually triggered by the first serious interest rate hike, which incidentally happened today, you would expect to see people moving from other assets into the land market.

David Light, Land Broker Co-op⠀⠀